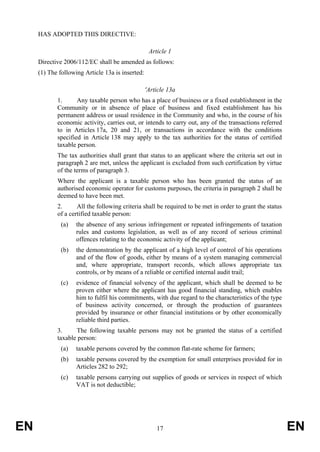

Council Implementing Regulation (EU) No 282/2011 of 15 March 2011 laying down implementing measures for Directive 2006/112/EC on

File:Council Implementing Decision (EU) 2020-647 of 11 May 2020 authorising the Italian Republic to apply a special measure derogating from Article 285 of Directive 2006-112-EC on the common system of value added