OECD Tax on Twitter: "What's the benefit of #AEOI? 9⃣0⃣+ jurisdictions have identified over €9⃣5⃣ billion in additional revenue through voluntary disclosure of offshore accounts, financial assets & income. Find out more

The Asia initiative - Global forum on transparency and exchange of information for tax purposes (OECD) - Articles

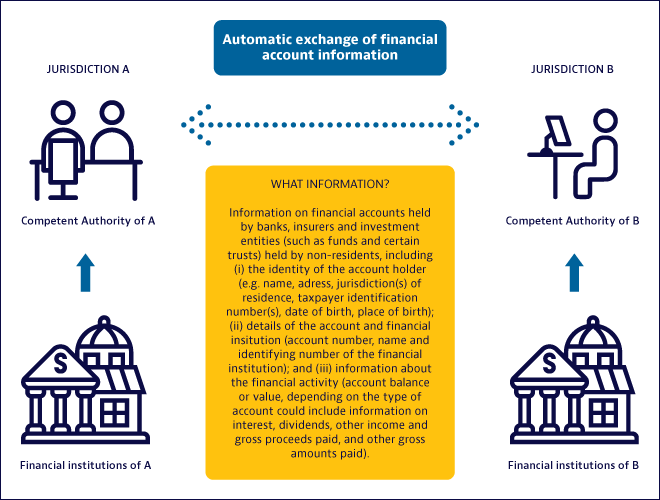

Standard for Automatic Exchange of Financial Account Information in Tax Matters: Organization for Economic Cooperation and Development: 9789264267985: Amazon.com: Books

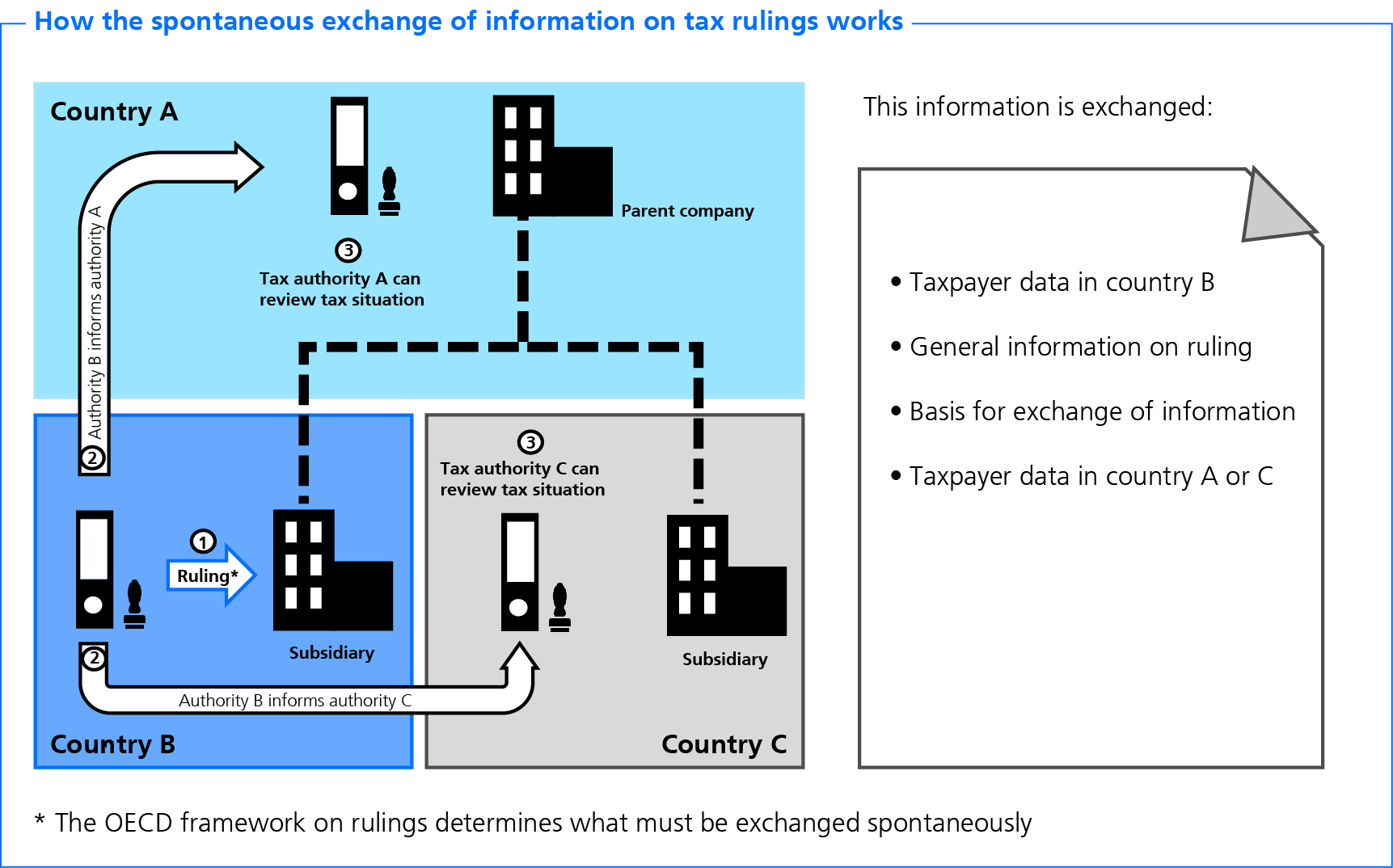

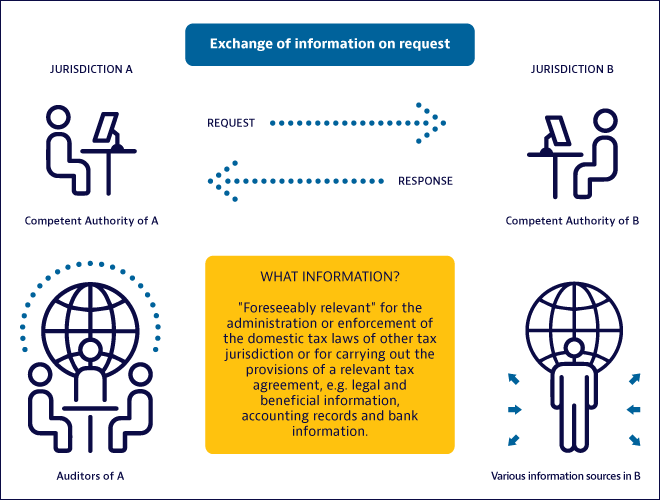

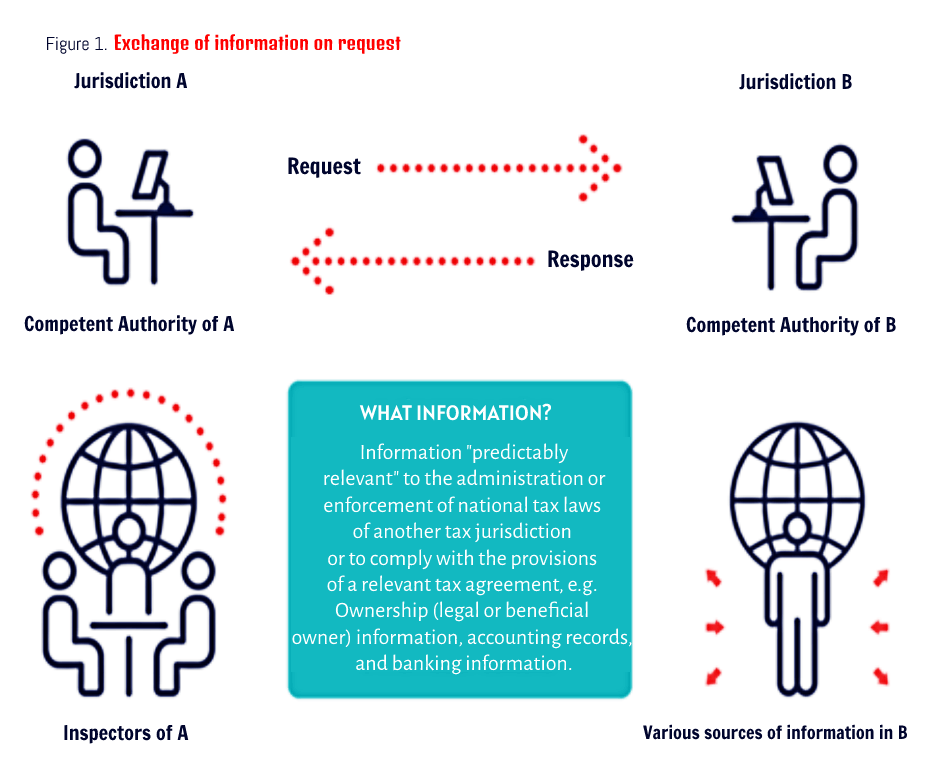

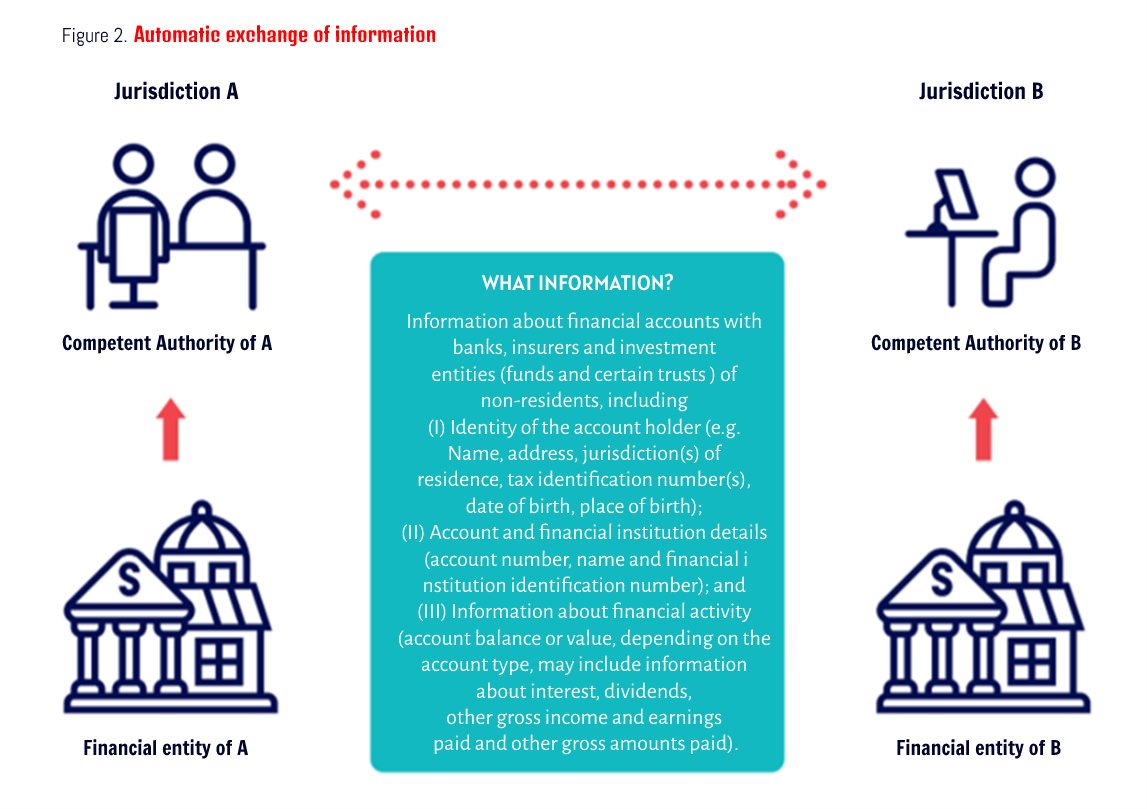

A fundamental tool for the Latin American Tax Administrations: the exchange of Tax Information | Inter-American Center of Tax Administrations

A fundamental tool for the Latin American Tax Administrations: the exchange of Tax Information | Inter-American Center of Tax Administrations

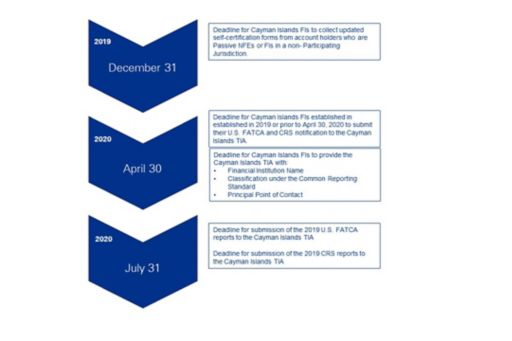

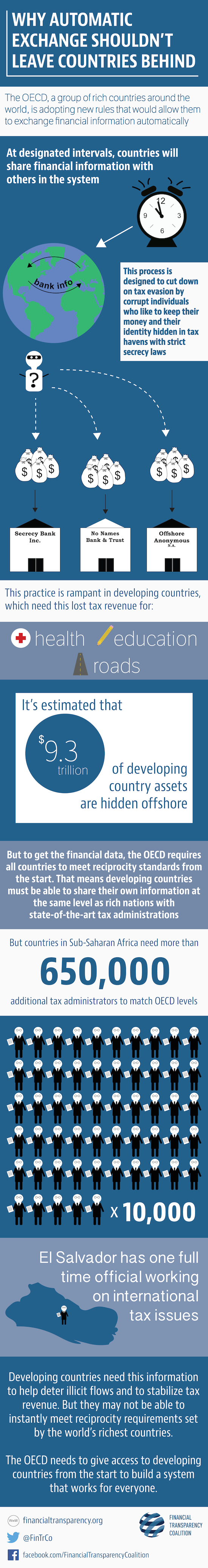

INFOGRAPHIC: Automatic Exchange of Information Shouldn't Leave Countries Behind - Financial Transparency Coalition